In Pursuit of The Trivial

Schrödinger’s Customer: Why Quantum Thinking Is the Next Frontier of CRM Strategy

Opening the box

In 1935, Erwin Schrödinger placed a hypothetical cat inside a sealed box with a vial of poison triggered by a hypothetical quantum event. Until we peek inside, the cat—so the thought experiment goes—is simultaneously alive and dead. Modern theorists have just offered a fresh twist: every possible outcome spins off into its own “mini‑universe”, so the cat is alive in one world and dead in another, with the act of observation pinning us to a single reality.

Now swap the cat for your customer file. At the exact instant an email is opened, a web page browsed or a store aisle entered, we cannot know—with absolute certainty—whether the individual is a ready to buy , nowhere near or somewhere in-between. Like Schrödinger’s cat, their commercial state is a super‑position—where two opposing conditions are simultaneously true until measured—of possibilities until interaction or engagement collapses it. In a multiverse of intents, marketers are the physicists wielding the measuring device.

The marketer’s uncertainty principle

Classic CRM theory tries to put people in neat buckets: acquisition, growth, retention, win‑back. Reality is messier. The same human may:

Upgrade a family car (5‑year cycle)

Top‑up mobile data (30‑day cycle)

Buy milk for tomorrow’s latte (48‑hour cycle)

Actually in the my grocery world this could be applied to different products from one supermarket

Milk - multiple consumption occasions

Butter - semi regular consumption and purchase

Chocolate - monthly treat

From their perspective each decision feels immediate and singular. From ours, the “customer wave‑function” spreads across multiple product universes with wildly different decay rates. We only see a blurred probability cloud.

The business risk is obvious: we blast a cross‑sell for a new car at someone still nursing last month’s loan approval, or we ignore a daily grocery buyer because they don’t fit our high‑value segment. Either way, we lose traction at the decisive moment.

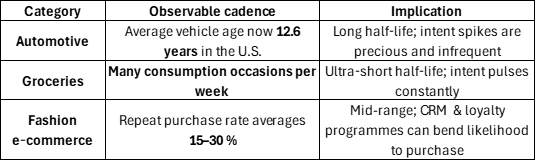

Purchase cadence as quantum half‑life

Physics gives us half‑life: the time it takes for half a radioactive sample to decay. Marketing has an equivalent in purchase cadence:

Cadence dictates how quickly a customer’s wave‑function collapses back into uncertainty after purchase. The longer the half‑life, the greater the danger of treating everyone as “not‑in‑market” for years at a stretch. The shorter the half‑life, the opposite danger applies: over‑marketing a buyer who already is in a perpetual purchase cycle and resents redundant nudges.

Living in many marketing worlds

The new multiverse explanation of Schrödinger’s paradox says the cat’s fate is determined by the entanglement between its tiny quantum system and the gigantic environment surrounding it. In CRM, entanglement is the mesh of first‑, second‑ and third‑party data that binds a customer to our brand universe:

First‑party: transaction history, loyalty points, product registrations

Second‑party: retailer sell‑through, open‑banking spend data

Third‑party: geo‑signals, social follows, credit bureau triggers

Each new data point we collect is like a photon hitting the cat’s box—altering our perception of the state we will eventually observe. Handled responsibly, these data connections must respect privacy from the very first touch—responsible use underpins every quantum leap we hope to make.

Rich entanglement speeds up certainty (“Jane is back in market for skincare as she has added the product to the basket”), poor entanglement leaves the system hazy (“Jane just browsed, maybe she’s price‑comparing”).

Macro‑environmental fields: economy, seasonality & cultural spikes – and their impact on each Intent Certainty Matrix

Quantum physicists know that even stable particles behave differently when exposed to external fields. In commerce, those “fields” are the macro forces that bend the trajectory of intent long before the individual meets our brand universe.

Economic outlook – the invisible hand on the dial

Rising interest rates or consumer‑confidence dips lengthen the half‑life of discretionary purchases (cars, holidays) but compress the cadence of essential outgoings (pay‑as‑you‑go energy top‑ups), while potentially reducing the value of each of the essential outgoings.

Inflation behaves like background radiation: it raises the noise floor in all categories, demanding higher signal density to achieve the same certainty threshold.

Seasonality – the thermal agitator

A 5 °C drop can lift hot‑beverage sachet sales by double digits within 24 hours; the same weather swing defers outdoor DIY projects, delaying paint and timber intent by weeks.

Holiday travel peaks create predictable surges in fuel, EV‑charging and quick‑serve restaurants; a heatwave triggers apparel intent for lightweight fabrics while simultaneously reducing dairy demand.

Cultural shopping occasions – scheduled collisions

Black Friday, Singles’ Day, Eid, Diwali, Prime Day: all act like particle accelerators, concentrating otherwise diffuse intent into narrow time windows.

Probability amplitude spikes across multiple universes at once—consumers shop for electronics, fashion and groceries in a single session—so cross‑category data collaboration becomes a competitive edge.

Macro factors do not replace micro‑signals; they modulate them. Feed economic and meteorological data streams into your propensity models, and time‑box offers around cultural spikes.

A narrative tour of four adjacent universes

Let’s step through four illustrative categories beyond cars and milk:

Streaming subscriptions – churn risk spikes near renewal dates but micro‑intent (episode choice) happens nightly.

Utilities – switching rates hover around single digits annually; yet usage data flows hourly from smart meters.

Fast fashion – trend cycles compress to weeks; garment durability extends to years; resale markets introduce parallel ownership universes.

Home improvement – major refurbishments every decade, but small DIY projects every quarter.

Across these universes the marketer’s job is identical: sense the collapse conditions (the signals that precipitate a transaction) and nudge consumers into the universe where they buy from us.

The Intent Certainty Matrix™

Where we plot signal richness against the category half life

X‑axis: Purchase Half‑Life – Short • Medium • Long

Y‑axis: Signal Density – Sparse • Moderate • Rich

Using the matrix, practitioners diagnose where each product line sits today, then design data/tech road‑maps to migrate to richer‑signal quadrants—shrinking uncertainty.

Four principles for collapsing the wave‑function

Instrument the environment

Invest in sensor data—loyalty apps, IoT devices, open banking feeds. If physics teaches anything, it’s that better detectors yield clearer observations.Model the probability cloud

Replace rigid RFM with machine‑learning propensity scores that update in near‑real‑time. Your data‑science team becomes the quantum mathematician calculating the wave equation.Orchestrate adaptive nudges

Build journeys that trigger when confidence passes a threshold, not on fixed calendar dates. Content, channel and offer should reflect the current probability amplitude, not last quarter’s static segment.Run perpetual experiments

Every interaction is a measurement and a perturbation. Treat campaigns as controlled experiments to refine priors—Bayesian thinking over classic A/B alone.

Measurement: from cat outcomes to customer KPIs

Success metrics must evolve into understanding the quality of the signals:

For example, if your skincare D2C store shrinks half‑life from 90 days to 60 days, the revenue uplift compounds geometrically.

What best‑in‑class looks like

A US based Auto Finance Company pairs Global vehicle replacement data with credit‑bureau pre‑qualifications to surface “micro‑moments” 18 months before the average replacement window.

A Korean Grocery Brand analyses loyalty basket gaps; if milk hasn’t appeared in seven days—a statistical outlier given weekly usage occasions—the shopper gets a push coupon at 4 p.m., just before the evening commute.

A Boutique Apparel Brand tracks wardrobe scans via its style‑app; when repeat‑purchase probability crosses the 30 % industry median, it auto‑generates a personalised look‑book summarising pieces that match items the customer already owns.

Governing the multiverse responsibly

Quantum metaphors are fun, but we must ground them in ethics. Just because we can observe every micro‑signal doesn’t mean we should. Adopt transparent consent management and algorithmic fairness checks; otherwise, the observer effect will provoke privacy backlash instead of purchase intent.

Embracing uncertainty as a strategic asset

Malcolm Gladwell reminds us that success often hinges on reframing the problem. Schrödinger’s customer reframes CRM from “How do we classify people?” to “How do we make peace with unknowability—and design systems that learn at the speed of intention?”

McKinsey would say: uncertainty is a cost and an opportunity. MBA finance classes call this option value—the value embedded in flexibility. Your CRM stack is an options portfolio on future customer states. The marketer’s job is to price those options accurately, exercise them at the optimal moment, and hedge the rest.

So, the next time your team debates whether Jane in postcode SW11 is a loyalist or a lapse risk, remember the cat. Jane simultaneously is and is not your customer—until data collapses her intent. Design for that paradox, and you won’t just manage loyalty. You’ll master the quantum art of creating it.

Have I ever mentioned my first degree in Astrophysics? ;-)*

What I’m Reading this Week

1. ScienceAlert – Schrödinger’s Cat and the Multiverse

CRM in a Multiverse?

A fresh take on Schrödinger’s Cat suggests all outcomes exist — just in parallel realities. Fun thought for CRM: what if every customer journey already exists too? Our job isn't to predict the future, but to choose the right version of it — with data as our quantum compass.

2. Devico – 8 Common Mistakes in Data Strategy

Data Strategy ≠ Data Storage

Devico exposes eight traps that kill business data strategies: siloed thinking, unclear goals, and tech without purpose. The fix? Start with business value, build for usability, and remember — data is a means, not an end. Good strategy isn’t about collecting everything, but unlocking something useful.https://devico.io/blog/8-common-mistakes-in-business-data-strategy-and-how-to-avoid-them

3. CGA – Which Comes First: Tech or Customer?

Tech Is Not the Strategy

CGA nails the eternal truth: don’t lead with tech, lead with need. Too many CX initiatives fail because they retrofit tools to journeys. Instead, anchor in customer problems, then find tech that enables — not dazzles. Innovation isn’t newness. It’s usefulness that actually shows up in the experience.https://www.cgaexperience.com/2022/04/25/which-comes-first-the-technology-or-the-customer/

What I'm Watching This Week

Winning the loyalty game: Gen AI, personalization and what really works

https://www.thoughtworks.com/about-us/events/webinars/winning-the-loyalty-game-webinar

My Quote of The Week

Thoughts From The Week

"Great CRM doesn’t just deliver communications—it delivers clarity."

"If you only know your customers’ transactions and not their motivations, you don't really know them at all."

"Automating convenience should never automate care—real loyalty requires genuine human connection."

gianfranco